Recently, Dr. Naeem Faraz, a SBC lecturer in business, published an article titled “Spendception: The Psychological Impact of Digital Payments on Consumer Purchase Behavior and Impulse Buying” in Behavioral Sciences (2.5, JCR-Q2). SBC-USST was the first unit, and Dr. Faraz was the first author.

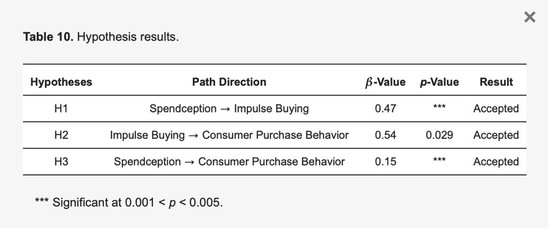

This study introduces a novel construct, Spendception, which conceptualizes the psychological impact of digital payment systems on consumer behavior. This research aims to explore the role of Spendception in increasing consumer purchase behavior, whereas the role of impulse buying has been observed as a mediator. To test the proposed model, an extensive survey was performed by collecting 1162 respondents from all walks of life to get the real picture. We employed exploratory factor analysis (EFA) and confirmatory factor analysis (CFA) to validate the measurement of key constructs. To test the hypothetical relations among all the variables, we employed structural equation modeling (SEM). Furthermore, a machine learning technique was used to test the robustness of the model. Results showed that Spendception greatly boosted the consumer purchase behavior, with impulse buying partially mediating the relation. Gender was found to moderate the relationship, with female consumers being more susceptible to impulse buying caused by Spendception. The study showed that digital payment systems made buying feel less noticeable, which led to people spending more without realizing the financial impact.

This study introduces Spendception, a novel construct that extends existing consumer behavior theories by explaining how digital payment systems reduce psychological barriers to spending. It bridges the gap between Spendception and the pain of paying, demonstrating that the lack of immediate visibility and physicality in digital payments alters consumers’ perceptions of spending, leading to impulse buying and higher purchase behavior. The findings also offer actionable insights for marketers in designing targeted campaigns that leverage the psychological effects of Spendception. The findings provide actionable insights for marketers to design targeted campaigns and for policymakers to promote financial literacy, ensuring ethical use of digital payment systems.

Related: https://doi.org/10.3390/bs15030387